A Beginner’s Guide to test your trading

A Forex demo account is a simulated trading account offered by brokers or trading platforms that allows individuals to practice trading in the foreign exchange (Forex) market using virtual money instead of real funds. These demo accounts are designed to simulate real market conditions, providing a risk-free environment for traders, especially beginners, to learn, practice, and familiarize themselves with the dynamics of Forex trading.

You will get $10000 as virtual money to trade. You will get enough time to play around. Trade, do mistakes, learn from it and get your tone get ready for the real world. Now we will directly get in to the business. Let us see how we can start a trading.

Go to Menu “File”

Then “Login to Trade Account”

Let us see a what is Market Execution and Pending order now

In the world of Forex trading, Market Execution and Pending Orders are two fundamental concepts that traders use to enter and manage their positions. Let’s explore the key differences between them with examples:

Market Execution:

Market execution is a type of order where you instruct your broker to execute a trade immediately at the current market price. This means that your order is filled as soon as there is a willing counterparty in the market to take the other side of your trade.

Example of Market Execution:

Imagine you are a Forex trader and you want to buy the EUR/USD currency pair. The current market price for EUR/USD is 1.1200. You decide to enter a market execution order to buy one lot (which is 100,000 units) of EUR/USD. Your broker will execute the trade at the prevailing market price of 1.1200, and you will be instantly in the trade.

If the market is volatile, the price may change slightly by the time your order is executed, but your trade will be filled at the best available price at that moment.

Now let us do a transaction!

Now you can either decide on this graph as the graph is moving downwards. Better to do a training buying transaction by clicking the blue button “Buy by market”

You trading will begin instantly and you will se how things are working in the dashboard as shown below.

Here in this example we did a (1) selling trading for EURUSD currency pair at the rate (2) 1.10247. We also set a (3) Take Profit below that amount as 1.10237 and currently you can se the results (4) as – $680 loss in this example.

Note: Here the trading was done for volume 8.00. If we ‘d have done that for less value the profit or loss would be lesser than that amount. Also, be aware that you also will have less risk if you lose.

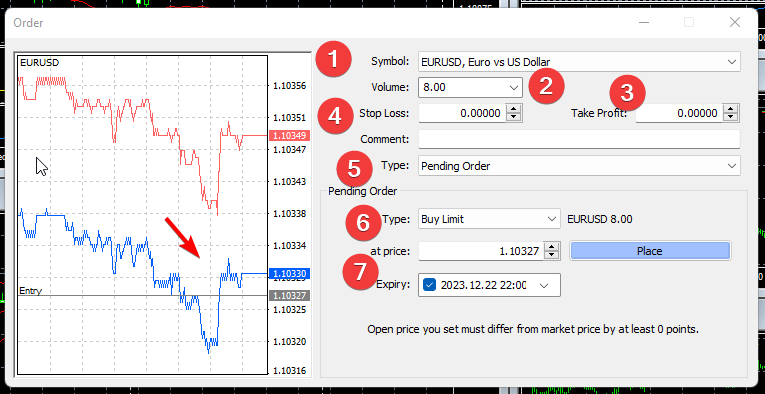

Pending Order:

A pending order, on the other hand, is an order in which you specify a price at which you want to enter the market in the future. The trade is not executed immediately but is “pending” until the market reaches the price you’ve specified. There are several types of pending orders:

Buy Limit Order: You set a price below the current market price, and when the market reaches that price, a buy order is triggered. It’s used when you believe the price will reverse and rise after reaching a certain level.

Sell Limit Order: Similar to a Buy Limit Order, but used when you think the price will reverse and fall after reaching a certain level.

Buy Stop Order: You set a price above the current market price, and when the market reaches that price, a buy order is triggered. It’s used when you believe the price will continue to rise after reaching a certain level.

Sell Stop Order: Similar to a Buy Stop Order, but used when you think the price will continue to fall after reaching a certain level.

In summary, Market Execution orders are executed instantly at the current market price, while Pending Orders allow you to set specific entry points in the future, based on your trading strategy and analysis. Both types of orders have their uses in Forex trading and can help traders manage their positions effectively.

Risk-Free Environment: Demo accounts provide a risk-free environment for traders to practice without risking real money. It allows beginners to familiarize themselves with trading concepts, tools, and platforms without financial consequences.

Learn and Understand the Market: Traders can learn about the dynamics of the Forex market, including currency pairs, price movements, market trends, and how various factors influence exchange rates.

Practice Trading Strategies: Traders can experiment with different trading strategies, techniques, and approaches to understand which methods work best for them. This includes testing technical indicators, chart patterns, and fundamental analysis in real-time market conditions.

Familiarize with Trading Platforms: Demo accounts help traders become comfortable with the trading platform provided by their broker. Users can practice placing orders, setting stop-loss and take-profit levels, and accessing various tools and resources offered by the platform.

Evaluate Broker Services: It allows traders to evaluate the services provided by different brokers without committing real funds. This includes assessing execution speed, spreads, customer support, and other features offered by the broker.

Build Confidence: Using a demo account helps build confidence in one’s trading abilities. As traders gain experience and success in simulated trading, they may feel more prepared and confident when transitioning to live trading.

Test New Strategies and Tools: Traders can test new trading tools, expert advisors (EAs), or automated trading systems in a risk-free environment to assess their effectiveness before applying them to live trading.

Monitor Performance: Users can track their trading performance, analyze their trades, and identify areas for improvement. This process helps in refining strategies and making necessary adjustments before risking real capital.

No Time Limitation: Demo accounts often offer unlimited access, allowing traders to practice for as long as they need to feel confident before transitioning to live trading.

Next Lesson: Let us learn about Forex Broker>

© 2015-2023 PipupFX. All Rights Reserved.

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment. Do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions. Any data and information is provided ‘as is’ solely for informational purposes, and is not intended for trading purposes or advice. Past performance is not indicative of future results.